Meta and Microsoft: Monsters of Scale, Masters of the Stack

What their blowout quarters reveal about the new rules of AI-era business.

Animal spirits are roaring again. The U.S. economy just beat growth expectations (3% GDP vs. 2.3% expected). Mega-cap M&A is back ($25B Palo Alto–CyberArk deal). And two tech giants - Meta and Microsoft - delivered blowout quarters. Oh, and Microsoft joined the $4 trillion club - floating into rarefied air alongside Nvidia - before drifting just below, still flirting with the milestone.

It’s getting hard to wrap your head around the scale of Big Tech. These companies beat expectations by more than most startups’ entire TAM.

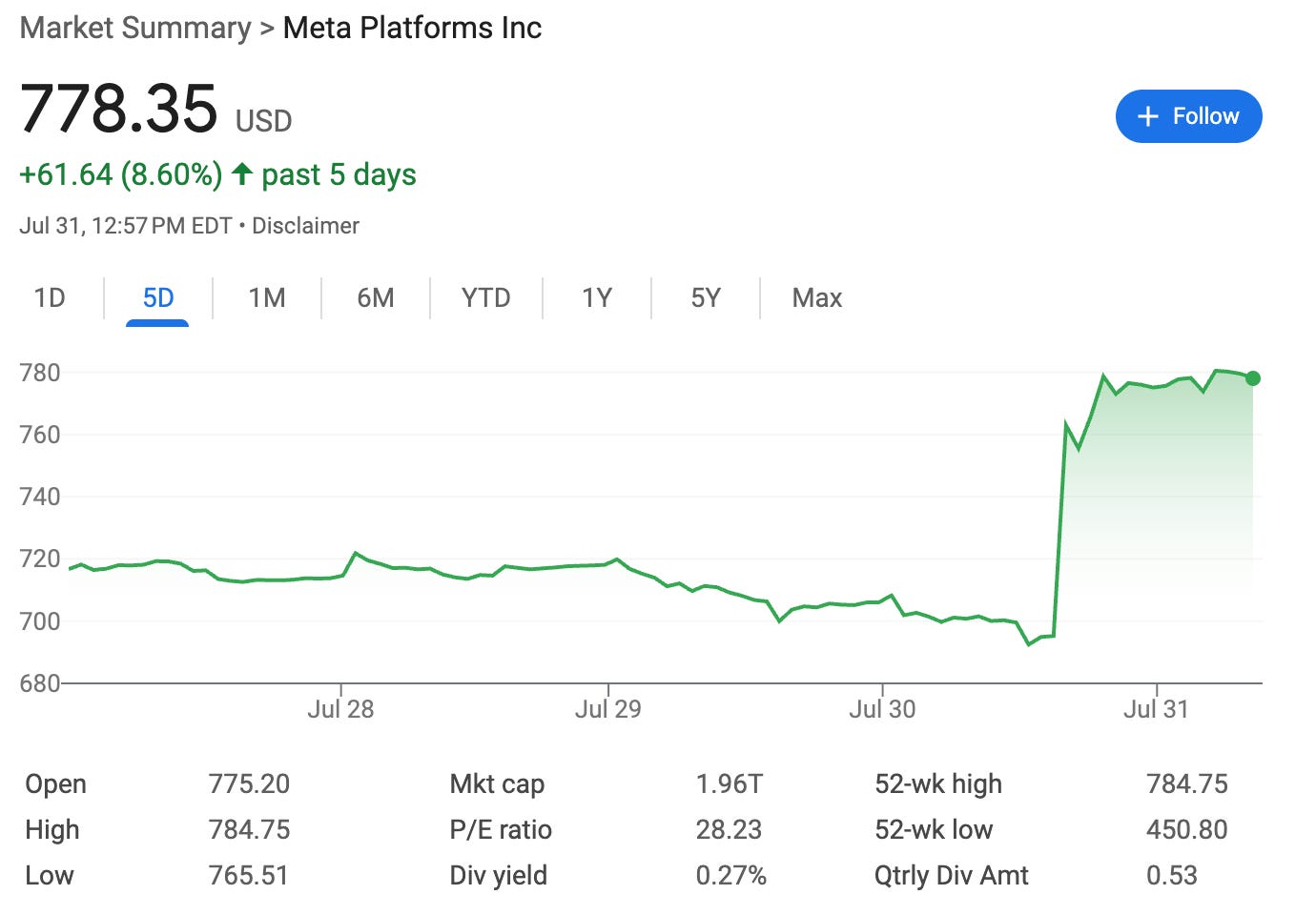

Meta reported $47.5B in revenue - vs. $44.8B expected - up 22% YoY. Operating income hit $20.4B (43% margin) with free cash flow at $8.5B, despite $17B in CapEx and $9.8B in stock buybacks.

Microsoft posted $76.7B in revenue - vs. $75B expected - up 18% YoY. Operating income reached $34.3B (44.9% margin), and free cash flow topped $30B, even as CapEx surged past $24B.

Both earnings had the same headline: AI is scaling, and so are margins. But the subtext is even more interesting.

Meta: Consumer Monster

(1) Growth Engines. Meta isn’t just investing in superintelligence. It’s already using GenAI to juice core performance. Their AI thesis is both future-looking and bottom-line-boosting. Zuck broke it down into 5 big bets:

Improved Advertising

AI-powered targeting is driving +3–5% uplift in conversions.

2M advertisers now use GenAI creative tools.More Engaging Experiences

Rec systems are sharper, content is stickier, and creators are getting surfaced faster.

Facebook time spent rose 5%, Instagram 6%.

Video time is up 20% YoY on both platforms.Business Messaging

Meta believes every business will soon have an AI agent - like an email address or website.

Click-to-message ad revenue is up 40% YoY in the U.S.

Ads are rolling out across WhatsApp Status & Channels.Meta AI (Assistant)

Powered by LLaMA 4, now live in 200+ countries with 1B+ MAUs.

Embedded across WhatsApp, FB Search, feed explainers, and image gen.AI Devices

Ray-Ban Meta Glasses remain supply-limited due to surging demand.

New Oakley models on the way.

Zuck: “Not wearing AI glasses will be a cognitive disadvantage.”

(2) Distribution Superpower. Meta now reaches 3.48B daily users. Zuck put it plainly: “There’s no other company as good at taking something and getting it in front of billions of people.” That distribution flywheel, paired with Meta’s product velocity and risk-on infra buildout, is a key part of Meta’s AI edge.

(3) Talent Bets. Zuck believes superintelligence is now “in sight.” So he’s going elite. He formally announced Meta Superintelligence Labs, led by Alexandr Wang (overall), Nat Friedman (AI products & applied research), Shengjia Zhao (Chief Scientist). He’s convinced: small, talent-dense teams are best for frontier research - a shift from Meta’s usual scaled machine learning orgs.

Meta isn’t waiting to reinvent itself. It’s doing it while compounding. And that, at scale, is what makes this company hard to bet against.

Microsoft: Enterprise Engine

(1) The Azure Juggernaut. Azure’s $75B annual revenue (+34% YoY) marks the culmination of a decade-long infrastructure bet that is now compounding with AI demand at hyperscale. Every Azure region is now “AI-first,” with the full stack being re-architected for inference, orchestration, and agentic workflows.

And Satya came ready with receipts. In a subtle-but-pointed flex aimed at competitors (read: Elon and Zuck), he noted: " There is a lot of talk in the industry about building the first gigawatt and multi-gigawatt datacenters. We stood up more than two gigawatts of new capacity over the past 12 months alone. And we continue to scale our owned datacenter capacity faster than any other competitor." That’s why it is called ‘hyperscale’, folks.

(2) Full Stack Play. Nadella outlined the new enterprise architecture that Microsoft plans to own: Infra → Data → App Runtime → Copilots → Agents.

Azure provides compute and orchestration.

Fabric and Purview manage the data layer.

Copilot is the interface layer, a new productivity OS.

Agents sit atop it all, handling workflows autonomously.

Other companies give you an API. Microsoft gives you the infrastructure, the middleware, the use case, and a polite enterprise salesperson named Mark who’s already on your calendar. Microsoft is sticky because it isn’t just the best infra. It’s the infra plus the interface plus the implementation.

(3) Risk-On Infra Buildout. CapEx is ballooning: $24B in last quarter, with >$30B planned next quarter. But it’s not speculative. Microsoft’s $368B in revenue backlog (+37% YoY) says the demand is real. That includes long-term enterprise contracts - and 40% of that revenue is set to convert within the year. They can hardly keep up.

This is the blueprint of a business that’s not just selling compute, it’s becoming the dominant substrate for AI-era enterprise software.

And there you have it.

Meta is betting on personal superintelligence - AI as UX. Embedded in your messages, your glasses, your scroll. It’s risky, uncanny, a little Black Mirror, but also inevitable. Because Meta has the users, the surface area, and now, the silicon.

Microsoft is betting on enterprise supremacy. Not just infrastructure, but orchestration, memory, agents, and governance. It doesn’t need to build AGI - it just needs to own the rails it runs on

Both companies are running different races. But they’re pulling away from the pack.

https://open.substack.com/pub/hamtechautomation/p/corporate-and-government-battle-for?utm_campaign=post&utm_medium=web