Microsoft and OpenAI Define the Relationship

A $250 billion framework for power, profit, and the future of intelligence.

After years of maneuvering and mistrust, the world’s most consequential corporate relationship in AI has finally reached an equilibrium. Before market open this morning, Microsoft and OpenAI published the new terms of their uneasy marriage - a contract that formalizes the balance of power at the center of artificial intelligence.

The partnership now runs through 2032, OpenAI is becoming a Public Benefit Corporation, and Microsoft’s stake resets to ~27% in the re-capitalized entity (valued ≈ $135B), down from ~32.5% previously.

OpenAI, in turn, commits an incremental $250B of Azure consumption and Microsoft gives up its right of first refusal to be OpenAI’s compute provider - a big tell on leverage and multi-cloud posture.

OpenAI gets new freedoms:

It can release open-weight models (if they’re sufficiently “safe”).

It can work with third parties and even other clouds for non-API products.

It can serve U.S. government customers on any infrastructure.

Microsoft in return gains:

An iron-clad anchor as the exclusive API home for OpenAI’s products.

Extended IP rights through 2032, now including post-AGI models. Research IP rights until 2030 or AGI verification.

The right to pursue AGI independently or with others.

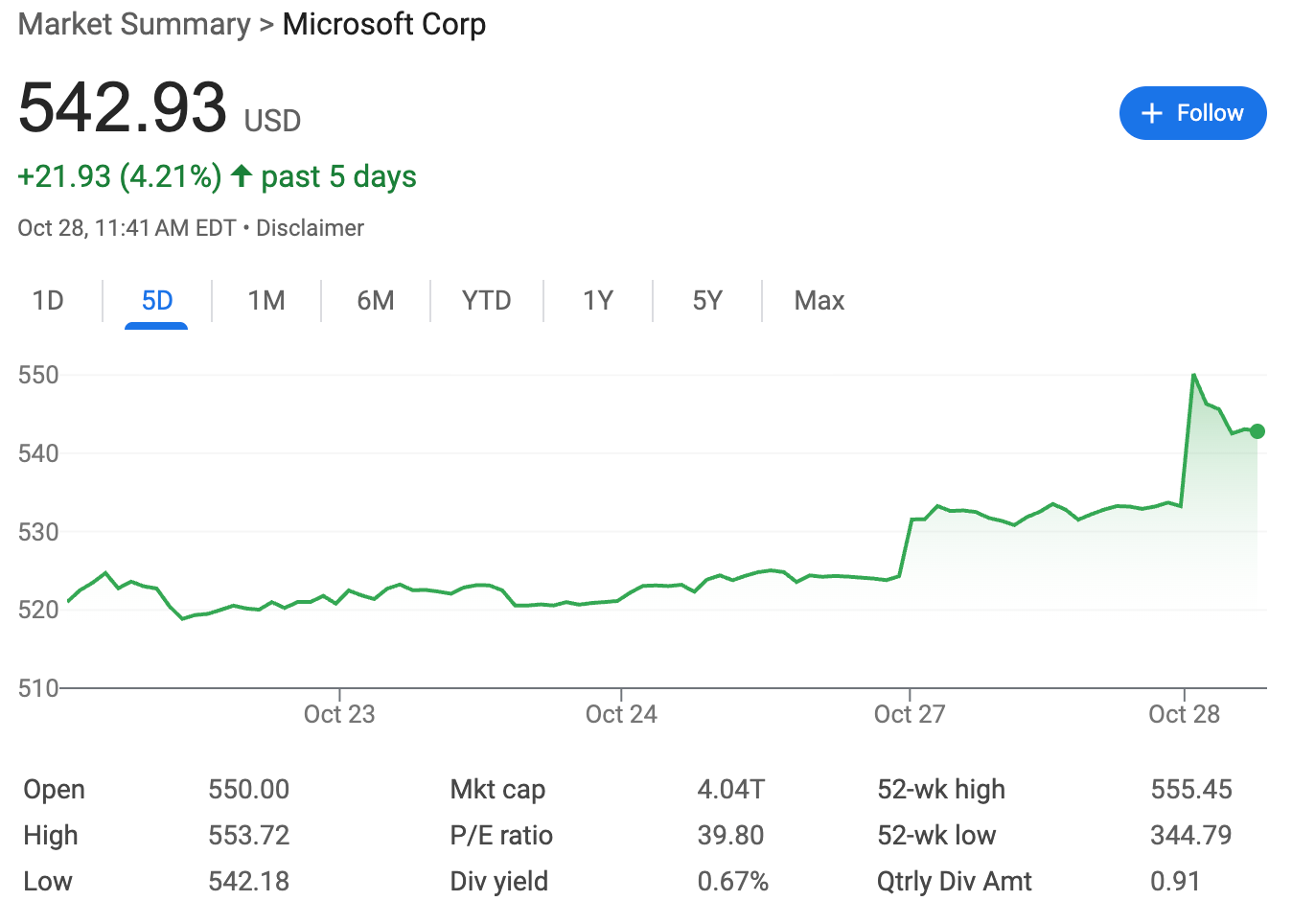

The market likes clarity, exhibit A below:

Some thoughts:

1. The AGI Verification Board (Because of Course There Is One)

There’s also now an independent expert panel that will verify when AGI has been achieved, which is a fun concept.

The agreement says, more or less, “If AGI happens, we’ll call a committee to confirm it,” which feels about as rigorous as having a subcommittee determine when love is real.

But the lawyers needed a trigger event to gate IP transitions, revenue share, and safety obligations, and “the dawn of artificial general intelligence” doesn’t slot neatly into a spreadsheet, so here we are.

2. Microsoft’s Strategy: Moats with Escape Hatches

Satya Nadella has perfected the art of contain-and-expand.

By locking Azure as OpenAI’s API monopoly, Microsoft ensures every token, prompt, and downstream product flows through its infrastructure - a toll booth on the future of software.

At the same time, it quietly negotiated the right to build its own AGI - like a spouse who adds “open relationship” terms to the prenup.

Classic Nadella: optimise upside, manage downside, keep options open.

3. OpenAI is Professionalizing.

The shift to a Public Benefit Corporation structure signals two things:

OpenAI wants a clearer fiduciary mission that balances profit with public good, and

it’s preparing for regulatory and political scrutiny that will inevitably follow the next leap in capability.

It’s less “move fast and break things,” more “move fast and brief Congress.”

4. The $250 Billion Energy Bill

The funniest number in the release is that $250B Azure commitment. That’s not a normal enterprise contract; that’s an energy policy. At these scales, “compute” becomes a synonym for electricity. Behind every model is a data center, behind every data center is a transformer substation, and behind every substation is a government trying to keep the grid alive.

If you’re wondering why hyperscalers are suddenly buying nuclear reactors, this is why: they’re not training models, they’re colonizing watts. This AI revolution is as much heavy infrastructure as it is software.

5. Governance is going corporate.

For years, AI safety was debated in academic papers and Twitter threads. Now it’s encoded in contracts. Compute thresholds, verification panels, open-weight conditions - all signals that the next phase of AI isn’t just a technological arms race, but a bureaucratic one.

The frontier is now run by lawyers and compliance officers. Which, depending on your optimism level, is either reassuring or dystopian.

The Strange Equilibrium

This deal has the dynamic of a hostage swap:

Microsoft locks in long-duration, high-visibility Azure revenue, retains model/product IP optionality through 2032, gains freedom to pursue AGI outright, and swaps ROFR for a bigger, cleaner consumption commitment + API exclusivity. That’s a portfolio of moats plus escape hatches.

OpenAI retains capital flexibility (via the PBC structure); gains ecosystem latitude (open weights, third-party clouds, non-API products); gains US-government distribution rights; retains the narrative of mission control while keeping the Azure compute lifeline intact.

It’s less master-servant, more mutual hostage situation - each holds leverage over the other, each is constrained by the other.

This deal only makes sense if both parties think AGI is coming soon enough to plan for. You don’t create a verification board or extend IP rights through 2032 unless you expect the world to look very different before then. Let’s see.

Great analysis!

It feels more and more that we have a huge elephant in the room, aka energy resources/investment. Would love to hear your thoughts on this. It doesn’t take a genius to see that Tech firms cannot suddenly become utility companies and that the AI infrastructure investment does not make financial sense.

Brilliant analysis of what's essentially a corporate peace treaty. Your framing of it as a "mutual hostage situation" is perfect - both parties constrained yet empowered. The AGI Verification Board is indeed hilarious; imagine being the person who has to declare "yep, that's AGI folks." Your point about the $250B commitment being an energy policy rather than a compute contract is crucial - this is infrastructure colonization disguised as cloud spending. The shift to Public Benefit Corporation status is fascinating; OpenAI positioning for regulatory scrutiny while Microsoft locks in the API moat. The "moats with escape hatches" framing captures Nadella's strategy beautifully. This isn't partnership, it's mutual insurance against an uncertain futre. The fact that they're extending IP rights through 2032 suggests they both believe AGI timelines are shorter than public messaging indicates. Excellent piece!