Nvidia’s Marketplace Power Play: From Chip Vendor to Cloud King

Nvidia used to just sell the picks and shovels. Now it’s eyeing the gold mine.

Last month, Nvidia quietly did something far more consequential than launching a faster chip or breaking a new benchmark. It launched DGX Cloud Lepton - a GPU “marketplace” that looks boring at first glance, but is actually Nvidia’s most strategic (and aggressive) move in years. It’s the kind of move that changes market structure, not just model performance.

Nvidia is no longer satisfied with just selling its GPUs to cloud providers (AWS, Microsoft, CoreWeave, etc.) who in turn rent them out to AI startups and enterprises. It’s building its own cloud services where AI developers can rent GPUs directly through Nvidia - no middleman needed. In this marketplace, Nvidia is

Aggregating other GPU cloud providers’ servers (like CoreWeave, Nebius) and offering them through Nvidia’s marketplace.

Also offering its own GPU servers - Nvidia’s direct inventory - side-by-side in the same marketplace.

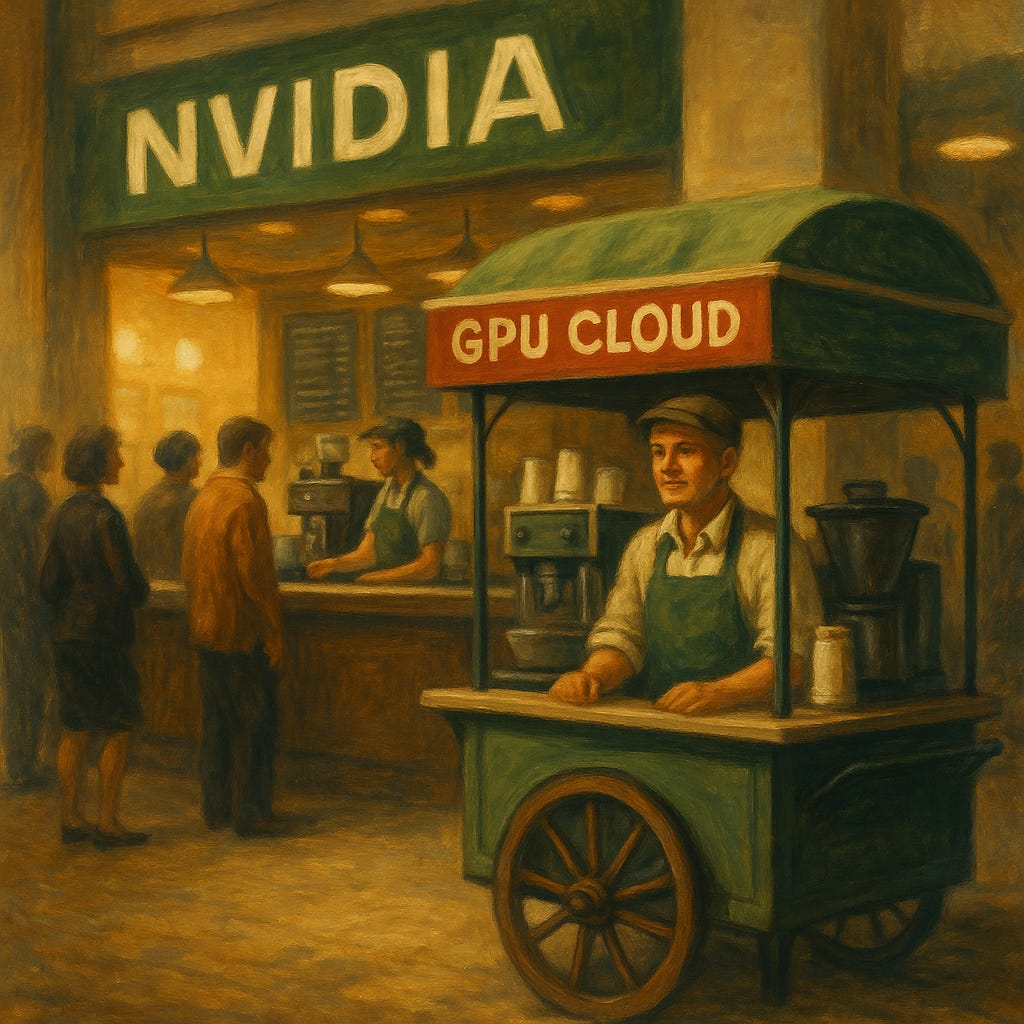

Imagine this: You run a small coffee shop, and there’s only one supplier in town with the magic beans you depend on. One day, that supplier opens a shiny mega-café across the street - then invites you to rent a cart inside their café, right next to their own barista counter. They own the beans, the building, the customer line, and the cash register. You smile, set up your cart, and hope that customers still want your custom blend, your faster service, or maybe just a break from the house special - even though it’s made with the same beans.

But why would Nvidia do this?

Because it can. And because the math is simple:

✅ Selling chips is good business.

✅ Renting chips is better business.

✅ Owning the customer relationship is the best business.

Nvidia isn’t just playing the hardware game anymore. It’s building the compute platform for AI, and this is its way of turning partners into inventory while capturing direct developer relationships.

And beyond the obvious?

Data advantage - the marketplace gives it visibility into customer demand patterns across partners, which it can use to optimize its own offerings.

Pricing power - Nvidia can subtly steer demand through pricing tiers and incentives over time.

The long-term trap - the more partners rely on Nvidia for customer flow, the harder it becomes to exit.

So why do GPU cloud providers go along with this?

Well, they don’t have a lot of great options.

GPUs are expensive. Every hour those chips sit idle, the business bleeds cash.

Lepton gives them access to more customers - and they need customers.

Opting out means watching competitors get those customer leads instead.

If they join Nvidia’s marketplace → they risk being commoditized, because Nvidia owns the customer relationship and can steer demand however it wants.

If they don’t join → they risk losing business to rivals who do join and get Nvidia’s blessing and customer flow.

One GPU cloud exec summed it up: “You’d rather play with Nvidia in the sandbox than not at all.”

And why doesn’t Nvidia just skip the partners entirely?

Good question.

Nvidia doesn’t have infinite manufacturing capacity.

It makes the chips, but it doesn’t want (or can’t yet afford) to own all the data centers, networking, power infrastructure, and operational muscle needed to serve all customers directly at global scale.

The GPU clouds (CoreWeave, Parasail, etc.) help Nvidia scale faster by building out data centers and serving diverse geographies and use cases.

Nvidia wants to keep its ecosystem wide… for now.

The GPU clouds act as Nvidia’s indirect sales force. They take Nvidia chips and find customers Nvidia wouldn’t reach on its own (e.g. smaller startups, niche verticals, international markets).

Cutting them off too soon could slow Nvidia’s revenue growth, limit its reach, or invite regulatory trouble faster.

Nvidia gets the best of both worlds.

By selling to GPU clouds and running its own marketplace (with both partner and Nvidia inventory), Nvidia keeps the chips flowing and builds direct customer relationships over time.

It’s like being both the wholesaler and the retailer - feeding partners today, but quietly positioning to own more of the value chain tomorrow.

Strategic cover.

If Nvidia tried to only sell direct right now, AWS, Microsoft, and regulators would howl that it’s abusing its monopoly in AI hardware.

By keeping partners in the loop, Nvidia can claim it’s fostering competition and supporting the ecosystem.

Nvidia is truly the master of the long game:

Let partners help grow the pie.

Meanwhile, build direct channels and brand loyalty.

When ready (and if regulation allows), control more of the customer journey.

DGX Cloud Lepton isn’t just a marketplace. It’s Nvidia’s bid to be the AI compute platform - where it owns the supply, the store, and the shopper.