🧾 Weekly Wrap Sheet (04/25/2025): AI Gets Smarter, Enterprises Get Serious & Google Steals the Spotlight

AI progress snapped expectations. Enterprise AI hardened. And the old front doors of the internet began to creak.

📈 Intelligence Accelerates

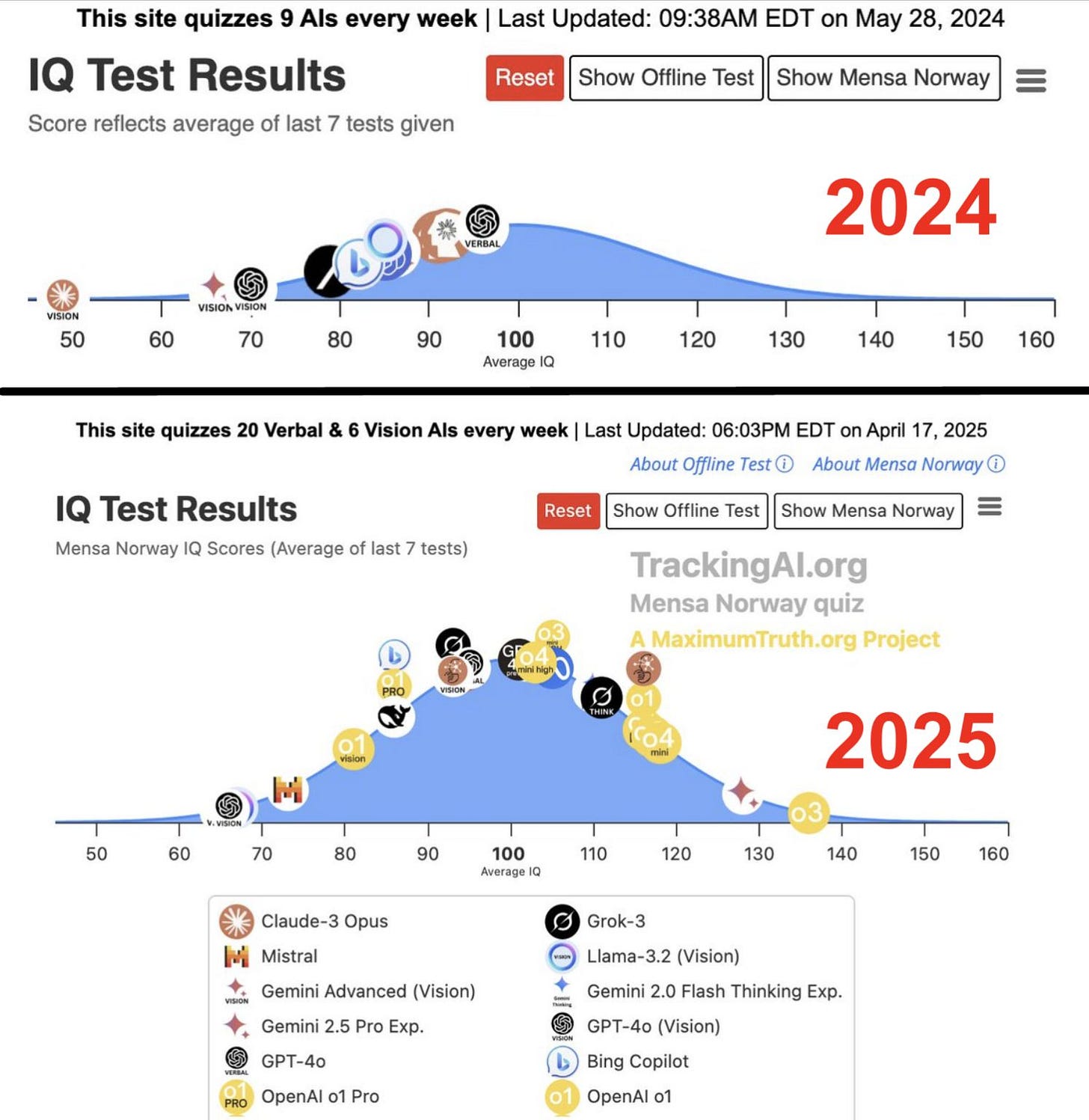

In one year, AI went from C student to valedictorian. In May 2024, AI models clustered around average human IQ. A year later, multiple models now break 130 - top 1% territory. The entire curve shifted right.

This isn’t normal progress. It’s acceleration that breaks your mental model of progress. In most fields, meaningful progress takes years. In AI, the world reboots with every model release. Benchmarks collapse. Expectations reset.

⚠️ Now, a couple of caveats, because this is the internet:

1️⃣ IQ isn’t everything. It’s a proxy for certain kinds of reasoning - pattern matching, analogies, etc. Not a measure of wisdom, judgment, emotional resilience, or the ability to not click “Reply All.”

2️⃣ These models still hallucinate. Yes, they score like geniuses. They also sometimes invent facts, forget the beginning of your prompt by the end, or confidently tell you that Paris is the capital of Italy.

But this speed of progress fractures our ability to predict. If AI IQ grew by 30 points in a year, what happens next?

🔹 Models that reason better than the smartest humans alive - and scale infinitely.

🔹 AI-native operating systems that orchestrate your calendar, your company, your life.

🔹 Agents that don’t just answer your questions - they ask better ones.

Do we start treating intelligence the way we treat electricity - ambient, abundant, a utility you pay for but no longer marvel at? The most mind-bending part to me is that this isn’t the ceiling. It’s the starting point.

🛠️ Enterprise AI: From Curiosity → Cost → Control

🔊 Enterprise AI has entered its third act. First, we asked: What can GenAI do? Then: What’s the ROI? Now: What platform do we scale?

🥚 2023 was the season of exploration - every team spinning up a POC, every vendor flashing a JPMorgan pilot like a badge of honor.

🐣 In 2024, the fun stopped being free. CFOs started asking uncomfortable questions. “Cool demo… but does it save us money?” AI budgets got real. Experiments got KPIs.

🐥 Now, in 2025, a quieter but more consequential shift is underway: standardization.

Across conversations with enterprise leaders, I’m hearing the same question: “How do we move from scattered pilots to a centralized, scalable AI strategy?”

Enterprises, structurally, do not want 50 bespoke solutions. They want vendor consolidation, procurement leverage, security compliance, and someone they can call at 2 AM when the thing breaks. The era of "let a thousand flowers bloom" was never going to last. Flowers don’t file SOC 2 reports.

And so the re-bundling begins:

▪️ AI councils are being formed - not just to accelerate deployment, but to also control it.

▪️ CIOs are centralizing stack decisions - not to say yes faster, but to say no with finality.

▪️ Companies are picking platforms, not tools - because tools are tactical. Platforms are defensible.

If 2023 was about curiosity, and 2024 was about cost, then 2025 is about control.

Who gets standardized? Who gets sunset? Who earns the trust to scale across the org? In enterprise, default status is destiny and the window for novelty is narrowing. Not every buyer is here yet. But among the top decile of adopters, the game has changed.

In the short run, innovation is permissionless.

In the long run, it’s procured.

🤖 From Copilots to Colleagues

Humans are expensive, emotional, and need PTO. Agents don’t.

We’re entering the post-human phase of productivity - not because it’s visionary, but because it’s faster, cheaper, and good enough.

A thought experiment I’ve been running lately: What breaks, bends, or quietly dies in a world where AI moves from task-based automation to team-based agent orchestration? 🤔

A future where AI agents aren’t just tools - they’re teammates. Specialists embedded into orgs. With memory, preferences, and domain expertise. Not copilots. Not chatbots. But employees, more or less. This isn’t a UX upgrade. It’s a rewrite of how we build, lead, and scale companies. A paradigm shift unspools an entire thread of questions:

🔧 Technical

Who manages the fleet?

Do we need a meta-agent - a kind of chief of staff for our AI teammates - to handle task routing, performance reviews, and conflict resolution?

Will agents evolve from being user-aware to org-aware - fluent in your roadmap, internal jargon, and unspoken norms?

💰 Business Model

If the world’s best SEO expert is now an AI agent with a Stripe page, how do you pay them? Per token? Per hour? A retainer?

Do companies employ agents like contractors - or subscribe to them like SaaS?

Does talent become a marketplace of agents?

🛍 Market Structure

Will we see the rise of an agent orchestration layer within the enterprise? Who owns this agent OS?

Do we enter an iOS vs. Android battle for agent ecosystems?

Will the best agent for Kubernetes, FinOps, or Growth be made by one company - or do we see a Cambrian explosion of vertical agent startups?

🛠 Practical

Anthropic’s CEO says AI will write all code within a year. Should you delay that migration?

Do engineers upskill as agent architects?

Do internal tools get rebuilt for agents first - not humans?

We’ll likely soon see a Chief Agent Officer. With a compliance budget. And a very, very long Slack thread titled “org ethics - do not archive.”

📉 The Consumer is Not OK

You feel it in surveys first.

You see it in snack aisles, nail salons, and Netflix queues next.

Now, it's hitting earnings:

PepsiCo reported a revenue and profit decline, cutting its full year forecast

Chipotle posted its first same-store sales decline since 2020.

American Airlines pulled guidance citing demand volatility.

As the PepsiCo CFO summed it up: “Relative to where we were three months ago, we probably aren’t feeling as good about the consumer now.”

Translation: ⚠️ The vibe is off.

This isn’t a single company issue - it’s a sentiment shift at scale. And that brings me to one of my favorite niche fascinations: The weirdest recession indicators economists have tracked over the years. The ones that don’t show up in government data sets but do show up when your friend says “I’m just rewatching The Office again” and you understand something deeper is happening.

💄 The Lipstick Index: Coined by Estee Lauder's chairman during the early 2000s downturn. When times are tough, consumers skip big luxuries and go for small pick-me-ups, like a $12 lipstick instead of a $1200 handbag. Emotional arbitrage.

🩲 The Men’s Underwear Index: Alan Greenspan said it, not me. The theory goes that men delay underwear purchases when things are bad, because it's invisible and, let’s face it, not a priority. So if sales dip, watch out.

👗 The Hemline Index: A 1920s theory suggesting hemlines rise during economic booms and fall during downturns, supposedly because modesty (and practicality?) take over.

💅 The Mani-Pedi Barometer: Beauty services are often first on the chopping block when money gets tight. If your nail tech has open slots all week, it might be time to rebalance your portfolio.

📺 The Comfort Binge Effect: Streaming platforms like Netflix have noted spikes in rewatching comfort shows (Friends, The Office) during economic downturns. Less experimentation, more regression to the emotional mean.

The economy doesn’t break all at once. It frays at the edges - in nail salons, snack aisles, and streaming queues.

🏛️ Google’s Breakout Quarter - and Possible Breakup

Google is having a main character moment. A breakout quarter … while a potential breakup looms. 📈📉 It just beat analyst expectations and crushed Q1 - revenue up 12% to $90B, operating income up 20% to $30B - and yet the company’s fate hangs in courtroom suspense.

The earnings beat was the headline. But the subtext was even stronger:

▪️Search is morphing, not dying. Early fears were that AI would cannibalize high-margin queries. Instead, AI is expanding Google's surface area - new query types, new ad formats, new user behaviors to monetize. AI Overviews, a new form of Google searching, has 1.5 billion users a month.

▪️Distribution power play. All 15 Google products with 500M+ users now run Gemini. Gemini API + AI Studio active users are up 200% this year.

▪️Gemini 2.5 Victory Lap. Sundar Pichai deservedly led the opening remarks by acknowledge the success of Gemini 2.5 'which is achieving breakthroughs in performance, and it’s widely recognized as the best model in the industry.'

▪️Capex ≠ cost center. $17B+ in quarterly spend looks aggressive -until you realize it’s buying structural advantage. Owning custom chips, data centers, and training pipelines isn't just cheaper - it's already driving a cost advantage for Gemini that competitors can't keep up with.

🧯 Meanwhile, in Washington: The DOJ has officially labeled Google a monopolist - and proposed a historic remedy: divest Google Chrome.

Let that sink in. If Chrome really goes up for sale, the future of the internet’s front door is officially up for grabs. How this plays out could reshape both search and the stack. Even wilder? The suitors circling:

👀 Yahoo, backed by Apollo, says it could catapult from 3% to double-digit share with Chrome in hand. (Truly, back the future)

👀 OpenAI floated interest - potentially turning Chrome into the ultimate ChatGPT interface.

👀 Perplexity raised its hand too, though unclear if they can actually afford it or just manifesting.

In this moment, Google feels both invincible and vulnerable - a surreal duality for a $2T company. Somehow, somewhere along the way, the giant became the underdog. And now, its comeback arc is wrapped in Gemini, fueled by distribution, and challenged by the DOJ.

🧠 TL;DR

AI’s IQ isn’t just climbing - it’s leaping. The distribution shifted in one year, shattering old baselines and forcing a mental model reboot.

Enterprise AI is moving from playground to procurement. Curiosity is out, control is in - and default status will determine who scales.

Agents are no longer copilots. They’re becoming teammates - and they’re starting to demand their own operating systems.

Consumer cracks are showing. Sentiment erosion is no longer theoretical. It’s hitting burritos, beauty, and airlines.

Google had a monster quarter - while facing a monster breakup. It’s winning the product race, but the courtroom battle may reshape the stack.