🧾 Weekly Wrap Sheet (06/13/2025): Reasoning, Reactors, Raids & Reboots

Apple heckles from the sidelines, Meta buys a second chance, OpenAI meters intelligence, and the AI arms race goes nuclear.

🎬 TL;DR

Apple, absent from the frontier, dismissed Chain-of-Thought as mimicry - a critique that says more about its strategy than the science.

WWDC 2025 didn’t wow, but Apple shipped its biggest AI shift yet: on-device models that could make AI invisible infrastructure.

Meta didn’t just buy a stake in Scale AI - it bought a narrative reboot, turning $14.8B into a bet that talent can fix strategy.

OpenAI compressed a quarter’s worth of moves into a week - new model tiers, multi-cloud pivots, sovereign funding, legal fights, and a reminder that ChatGPT still breaks.

The AI arms race ran headfirst into the power grid. Big Tech’s next breakthrough might be a reactor, not a model.

🍏 Apple Critiques Thinking - Without Shipping It

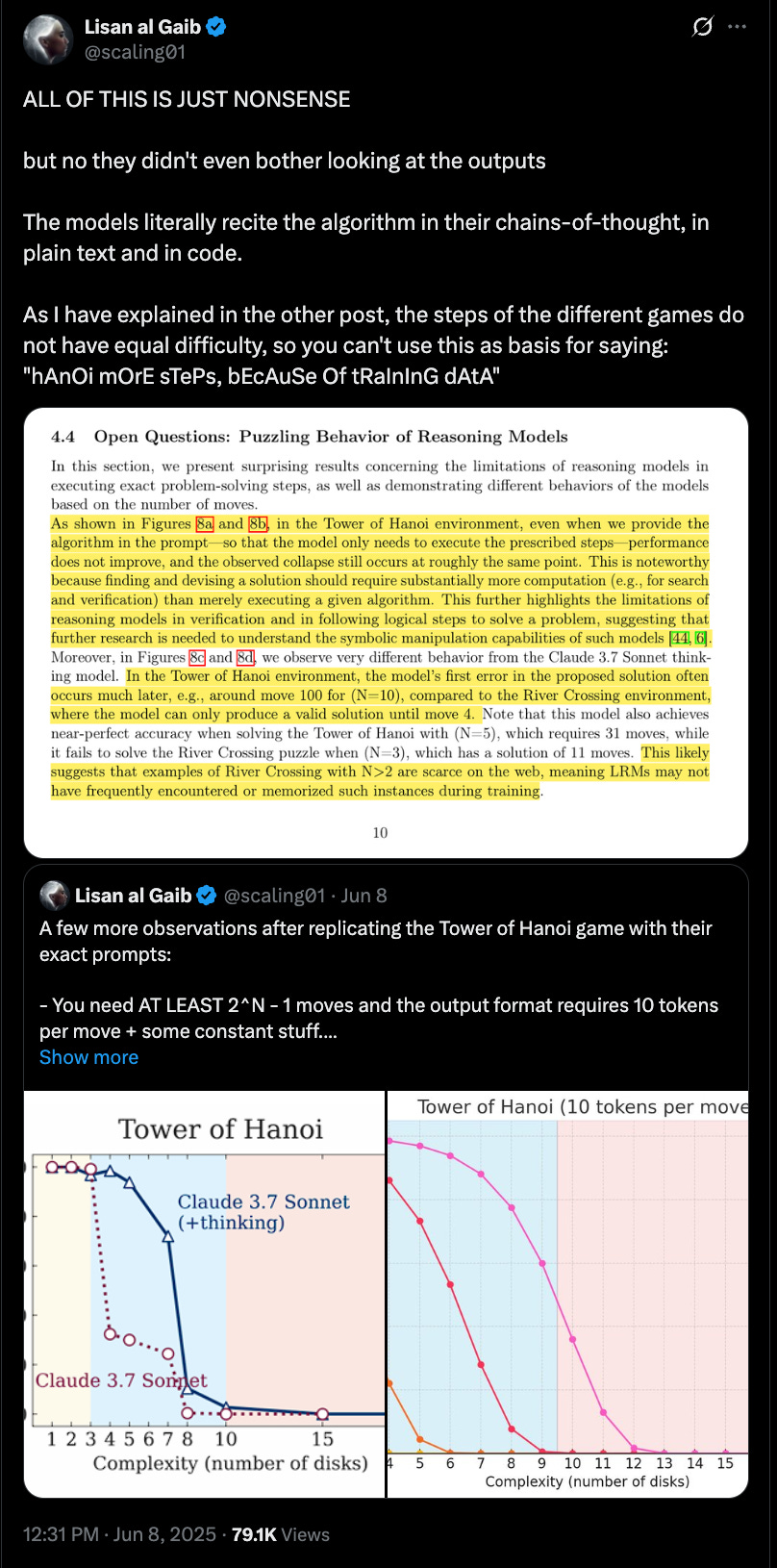

Apple released The Illusion of Thinking, a research paper arguing that Chain-of-Thought (CoT) reasoning is statistical mimicry masquerading as logic = useful for medium-difficulty tasks, but prone to collapse under real complexity.

Since its release, there has been ample debate, with significant pushback from the ML community. Some argue that the paper set CoT up to fail by stripping it of the context in which it actually shines. Apple tested CoT in isolation - no tools, no memory, no function calling, no iterative verification - ignoring how modern systems scaffold reasoning through external aids. Others point out that the paper imposed tight token limits, artificially cutting off longer reasoning chains that could have succeeded if given the space.

The paper landed with strong “guy on the couch yelling at Olympic athletes” energy - critiquing techniques Apple hasn’t helped build, on models it hasn’t trained, while contributing little to open AI progress itself.

The timing - days before WWDC - made the subtext hard to miss.The paper reads like a philosophical justification for Apple’s strategic restraint. "We’re not late to the AI race. We’re playing a smarter game.”

Perhaps they are. But if so - don’t just critique the approach. Ship the alternative.

📱 WWDC’s Quiet Power Play

WWDC 2025 felt like a brand maintenance release. No breakthrough features, no model drops, no dramatic AI unveilings. But beneath the surface, Apple made its most important AI move yet: opening up on-device foundation models to developers.

For the first time, developers can access Apple’s LLMs directly - with inference happening entirely on-device. No cloud calls. No token pricing. No data leaving the phone. Just local, privacy-first intelligence baked into the OS.

This is Apple trying to play the long game - turning AI from a feature into infrastructure, invisible and ambient, embedded everywhere. Instead of chasing raw scale, Apple is betting that the future of AI is controlled, local, and trust-based.

🤝 Meta Buys a Reboot

When product misses, Zuck reaches for M&A. This week, Meta didn’t just buy a 49% stake in Scale AI - it bought a narrative reset. The $14.8B deal wasn’t about customers (who will likely leave). It was about installing Alexandr Wang to run a new superintelligence lab and reboot Meta’s AI ambitions.

The structure is as strange as the price tag. No board seat. No control. Just enough ownership to break a supplier and bring the CEO in-house. This is what happens when you need a new story but can’t buy a controlling stake - or withstand another FTC fight.

When the rumors broke, I predicted Scale’s largest customers - other foundation model labs like Google and Anthropic - would stop doing business with them. And it’s already beginning:

It’s bold, expensive, and arguably destructive. Meta didn’t just pay billions for a new AI lab. It paid billions to dismantle its supplier and bet that talent alone can fix strategy.

⚡ OpenAI’s Week of Everything

OpenAI compressed a quarter’s worth of moves into a single week. It launched o3-pro - its most capable model yet - alongside a cheaper, stripped-down base version. The message: segmentation is here, and thinking will be metered.

It expanded beyond Microsoft, quietly shifting workloads to Google Cloud - because in this phase of AI, compute scarcity trumps loyalty. It pushed forward with the Softbank-led $40B fundraising effort, courting sovereign and strategic capital across Saudi Arabia, India, and the UAE - a sign that AI infrastructure is now geopolitics.

It suffered a 10-hour ChatGPT outage that reminded everyone the world’s most hyped AI product can still go down like a consumer app. And Sam Altman’s latest blog promised AI agents by 2025, scientific discovery by 2026, embodied robots by 2027 - staking a vision where productivity scales not with headcount, but with compute.

Tucked into Altman’s blog was this gem - a part that lingered with me long after the rest faded:

AI may render most roles functionally unnecessary - but that doesn’t mean our lives become vacuous. If history is a guide, we’ll redefine meaning outside of survival.

⚛️ AI’s Energy Reckoning: Big Tech Goes Nuclear

AI’s exponential energy appetite is quietly rebooting America’s nuclear industry.

Renewables can’t keep up with 24/7 inference demands, so Big Tech is bringing nuclear back.

Microsoft is leading the charge, investing $1.6 billion to restart Three Mile Island - the first U.S. reactor reboot since the 1980s. The 20‑year deal will funnel ~835 MW to its AI data centers via Constellation Energy.

Amazon signed a direct power purchase agreement with Talen Energy for up to 1,920 MW from the Susquehanna nuclear plant in Pennsylvania - a deal set to run until 2042, powering a massive AWS campus.

Google signed an agreement with Kairos Power includes 6–7 small modular reactors, first online by 2030.

Meta recently closed a 20-year PPA for 30 MW from Constellation and is evaluating up to 4 GW of nuclear capacity - a clear arcade from carbon offsets to grid ownership.

AI workloads require continuous, large-scale, carbon-free power that solar and wind can’t reliably deliver. Nuclear now stands not just as a climate hedge, but as a strategic moat for AI infrastructure - and company valuations. These aren’t future bets; they’re active investments being permitted, funded, and regulated now. What began as a GPU arms race is now an energy land grab.